A statutory employee is a mix of an independent contractor and a traditional employee. Of course there are certain types of income within this list that does not have to be included in your income for tax purposes in other words income that is exempted.

Hmrc P60 Digital Copy National Insurance Number Income Tax Details Document Templates

April 25 2022.

. Or who picks up and delivers laundry or dry cleaning if the. Statutory Income is also reffered to as Take Home Pay as it is the amount of money you take home after all deductions. Statutory employee is defned as an employee by law under a specifc statute.

Similar to independent contractors statutory employees may deduct business expense from W-2 earnings. Here is the step by step to get the correct income. Generally most individuals are determined to be employees under common law see Information Sheet.

These expenses are a miscellaneous deduction subject to 2 of your adjusted gross income and are claimed on Schedule A Itemized Deductions for years prior to 2018. As an independent contractor they pay their own income taxes and dont receive full-time employment perks but they do benefit from employer contributions toward Social Security and Medicare. Substantially all payments for their services as direct.

A driver who distributes beverages other than milk or meat vegetable fruit or bakery products. The interview will ask about employee business expenses job-related expenses in this section. A statutory employee is able to deduct their business expenses against their income on Schedule C just like independent contractors.

All Current Jobs Hiring Near You. Browse New Full And Part-Time PositionsApply Today Start Your Career Tomorrow. Statutory employees are regarded as independent contractors for income purposes but theyre considered employees from a federal insurance and medical care tax perspective.

Find Your Dream Job Near You Today. How to calculate income for the statutory employee. Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the Income Tax Act.

The IRS classifies only four different categories of an employee who can be considered statutory. Direct sellers and licensed real estate agents are treated as self-employed for all Federal tax purposes including income and employment taxes if. Newly Posted Jobs Near Me.

If youre not familiar with creating a Schedule C in TaxSlayer Pro see here for instructions. A statutory employee is a cross between an independent contractor and an employee. In Box 13 mark the box that says Statutory employee.

Here is a guide on what to fill out in the W-2 form. However the IRS does not require employers to do this for independent contractors. Here you should specify the amount you paid the employee.

Employers typically withhold a portion of an employees wages as a part of Social Security and Medicare tax and contribute a portion on their own as an employer. A statutory employee is an independent contractor or freelancer thats treated as an internal employee for tax purposes. An individual who wants to be treated as a statutory employee must meet specific criteria defined by the IRS.

A W-2 form is a paper you need to fill out and give to your statutory employees. Determine the amount of expenses to deduct. Jamaica Tax - Statutory Income.

But just like employed individuals statutory employees only have to pay half of their Medicare and Social Security taxes since their employer is paying the other half. These groups are considered statutory. Box 1 includes the taxable income wages salary bonuses and tips.

With this box checked the income from Box 1 will not show as wages in the Form 1040 Income menu Enter the W-2 Box 1 income in Schedule C Profit or Loss From Business. Ad Get Your Application In Soon For These New Full Part-Time Positions In Your Area. Direct sellers licensed real estate agents and certain companion sitters.

Specifically its a worker thats an employee under federal tax law but an independent contractor under common law. Despite this they must report expenses income and wage. Enter the Form W-2 in its menu ensuring Statutory Employee is checked in Box 13.

A statutory employee is a certain type of independent contractor. A statutory employee is an independent contractor under American common law who is treated as an employee. Even though a statutory employee is not a.

There are three categories of statutory nonemployees. Pay FICA tax through their employer and so do not pay self-employment tax. Statutory income from employment refers to not only your monthly salary but also any commission bonus allowances perquisites benefits-in-kind and even accommodation.

However certain groups of workers have been specifcally covered by the law for UI ETT and SDI purposes. The good news here is that working with a statutory employee requires almost all of the same items as working with a commissioned borrower. Click on Ill choose what I work on then select employment expenses.

A statutory employee is a special type of worker whose wages are not subject to federal income tax withholding but are subject to FICA Social Security and Medicare and FUTA unemployment taxes. Ad Major US Companies Are Hiring Now and Increasing Pay. A statutory employee is a type of independent contractor who is considered an employee for payroll tax purposes.

To determine whether a worker is an employee or independent contractor many companies utilize the common law test. Statutory employee meaning.

Example Of Resume Page 2 Resume Examples Budgeting Resume

Annual Leave Calculator Excel Free Download Xlstemplates Annual Leave Excel Templates Excel

Printable Sample Employment Contract Sample Form Contract Template Free Basic Templates Employment

Hr Generalist Practical Training With 100 Placement

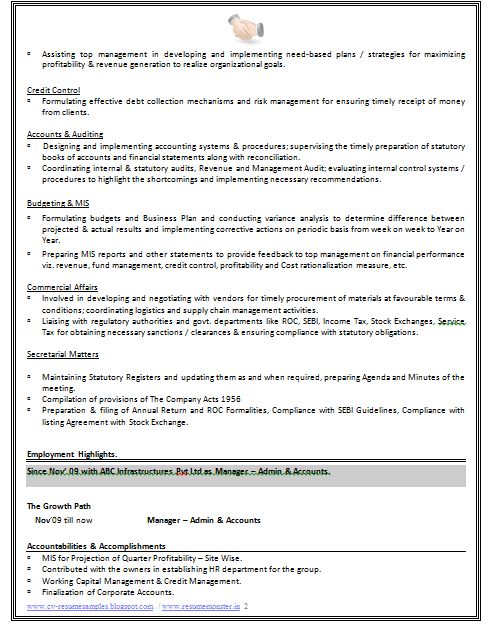

Good Cv Resume Sample For Experienced Chartered Accountant 2 Cv Resume Sample Accountant Resume Good Cv

Pin By Weivy Beiby On My Saves Security Tips How To Plan Employment

Employment Law Timeline Http Itz My Com Career Planning Human Resources Career Employment Law

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes

Link Aadhaar With Epf Uan Account Online Offline Process Accounting Online Accounting Bank Account

Law Student Resume Sample Resumecompanion Com Law School Life Law School Inspiration Law School Prep

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun

Hr Recruitment Manager Resume How To Draft A Hr Recruitment Manager Resume Download This Hr Recruitment Mana Manager Resume Resume Templates Download Resume

6 Hr Certificate Of Acknowledgment Calnotaryclass Com

Accountant Resume 2 Accountant Resume Risk Management Resume

Iict Networkingtraining Hardware Iict Is The No 1 Hardware And Networking Training Institute In Chennai Desktop Support Training Center Supportive

Step 3 Your Home Supportive Mortgage Lender